Possible Explanations of the Strong US Investment Growth in Q1 2022

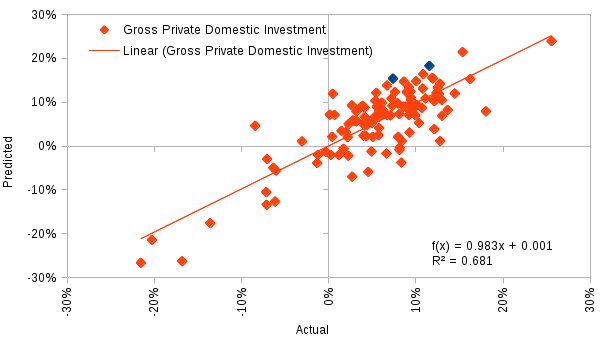

This article develops on the analysis regarding capital goods and investment. It tries to add insights to the simple forecasting model of US gross domestic investment by two variables: durable goods and non-defense capital goods excluding aircraft. The puzzling moment with this model is its relatively poor forecast quality in the last couple of quarters. More specifically, the investment growth was substantially overshooting its predicted values.

Three possible factors could be at play:

- aircraft production could have been ramped up ;

- defense spending could have increased;

- investments into houses and structures, which are not included in the capital goods, could have also been rising.

Clearly, several observations can be made from the recent data shown on the charts below.

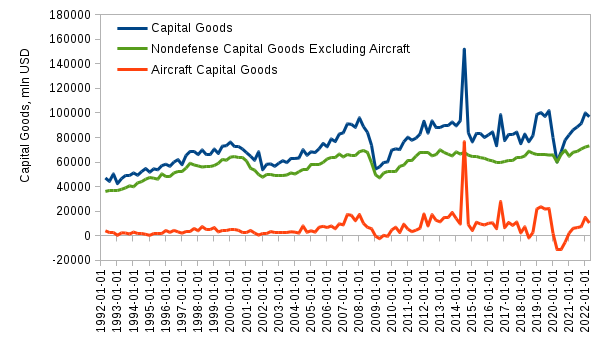

Aircraft Production

Indeed, aircraft manufacturing has increased recently. And it is influencing the data on investments. As the Coronavirus epidemic has been winding down aircraft production rebounded. Subsequently, it contributed to the difference in the actual investments in the last several quarters vs. the values predicted by the model.

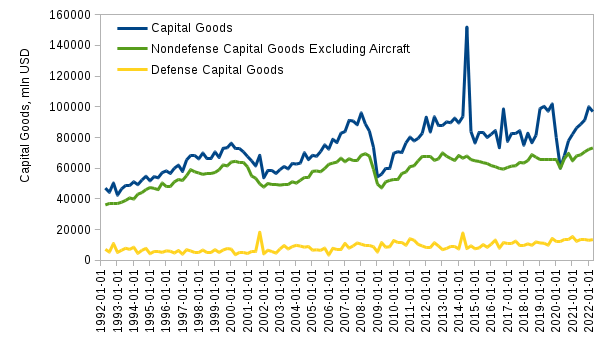

Defense Capital Goods

The second hypothesis was that defense spending was influencing the model results. Nevertheless, looking at the chart, it looks like it has not been the case. Defense spending stayed pretty flat lately. It still is pretty certain that defense capital goods production will go up after the plants and other facilities are loaded with the new orders from the government. The main trigger here is the replacement of the military equipment that was sent by the US government to Ukraine.

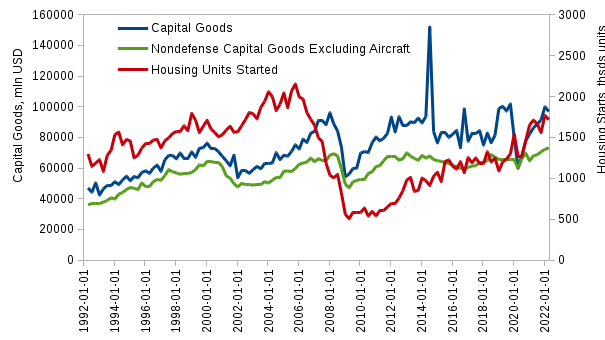

Housing Construction

The final conjecture was that residential or commercial construction contributed to the increase in the overall investments. As seen from the chart, it's patent that recently residential construction was up. Commercial construction data still needs to be checked. However, even the housing construction clearly contributed to the investment increase.

Summing up, several points can be mentioned:

- the simple modal that relies on just two factors, durable goods and non-defense capital goods excluding aircraft, is helpful in explaining significant parts of the investment variation;

- such a model still doesn't deal greatly with the recent quarters' data and a better model could be used;

- this new possible model could include housing and aircraft production as explanatory variables;

- nevertheless, one should be careful with the aircraft data as it is very volatile.